By transferring your credit card balance from a high-interest account to a 0% annual interest rate Long Advanced account, you can pay off your debt without increasing interest. Check the balance transfer fee before choosing a card to transfer this debt to.

Some credit card issuers charge a fee of typically 3% to 5% to accept balance transfers to new accounts. If you transfer $20,000 in debt, you will need to cover an additional $600 to $1,000.

However, other credit cards completely waive balance transfer fees, making them attractive to cardholders who don’t want to pay more. Remember, most new credit cards have an average interest rate per bank of 16.3% or higher when the APR adoption period expires.

If you’re considering transferring your credit card debt to a new account that doesn’t charge a balance transfer fee, go ahead and find the best partner deals below.

Longest April Rate Advance with $0 Referral Transfer Fee

Union Bank® Platinum™ Visa® credit card offers a 0% introductory annual interest rate for 15 months on both purchases and balance transfers, and balance transfers when you complete your first balance transfer within the first 60 days (within 3 days thereafter) of opening an account. The fee is $0. Minimum of $10 % of each transfer). At the end of the promotional APR period, a variable APR between 8.49% and 19.99% applies. The lower end of this range is very competitive compared to most balance transfer credit cards. And since there’s no annual fee, you can safely transfer your balance to this card at no extra cost if you’re diligent.

APR display midrange

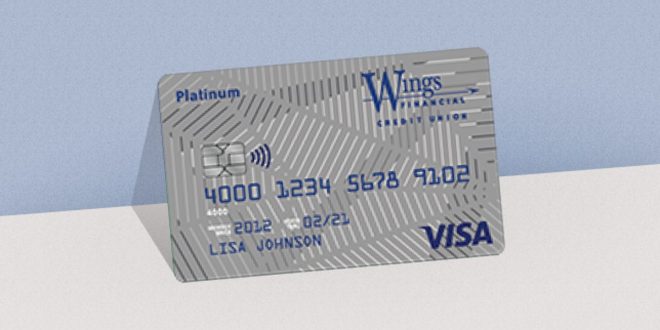

The Wings Financial Credit Union is based in Minnesota, but you can join the Wings Financial Foundation by donating $5 to the Wings Financial Foundation. You can then apply for a Wings Visa Platinum credit card* with no annual fees or balance transfer fees charged and a 0% introductory annual interest rate on balance transfers and purchases for 12 months (8.15% to 18.00% annual interest thereafter).

credit union road

First Tech Federal Credit Union, based in San Jose, California, initially serves the employees of technology companies in the Pacific Northwest. You can become a member by working for one of our current partner companies or by becoming a member of the Computer History Museum ($15 annual fee) or the Financial Fitness Association ($8 annual fee).

The First Tech Platinum Mastercard* credit card* also offers 12 billing cycles with 0% introductory APR for balance transfers (varying 6.99% to 18.00% APR thereafter) with no credit card balance transfer fees.

Low APR No Advance Balance Transfer Fees

The SunTrust Prime Rewards* credit card does not charge any balance transfer fees per se ($0 for balance transfers for the first 60 days, then at least 3% or $10). Instead, it offers a relatively low annual interest rate (variable 3.25%) for three years, which is a fixed transfer fee paid over one year. It should be noted that the effective rate is actually variable less than 3.25% if the balance is repayable.

Bottom Line: If you need more time to pay off your debt, SunTrust Mastercard Prime Rewards offers a balanced combination of low interest rates and long repayment terms.

Questions and Answers

How do balance transfer credit cards work?

When used correctly, a balance transfer credit card serves as a debt financing tool. They can help you pay off your existing high-interest credit card debt faster and less.

When you transfer credit, you transfer debt from one credit card to another. The best balance transfer cards allow you to pay off your debt without having to worry about the high interest rates that result from low or no interest rates over a set introduction period. This introductory APR typically lasts between 12 and 21 months, giving you ample time to pay off your balance before interest rates increase.

Some credit cards offer no-fee transfers, but most balance transfer cards charge a fee of 3-5% of the transferred balance. In general, the longer the 0% annual introduction period, the higher the fee and vice versa. Therefore, cards with no balance transfer fees have a shorter introduction year, and cards that charge a transfer fee have a longer introduction year.

Where can I find a credit card with no balance transfer fees?

We consider Wings Visa Platinum and First Tech Platinum to be the best credit cards with no balance transfer fees. Both offer introductory APR, but you have to pay between $5 and $15 to become a member. These fees are relatively low compared to typical balance transfer rates. For comparison, let’s say you transfer $5,000 in credit card debt. The 3% fee card charges a $150 fee, while the Wings Visa Platinum and First Tech Platinum members only cards require a $20 fee.

However, if you’re already a member of a credit union, it’s worth asking if they offer a balance transfer card with an annual interest rate of 0% and no balance transfer fee.

What are the benefits of a credit card with no balance transfer fees?

A credit card with no balance transfer fee allows you to transfer balances from one account to another without paying upfront a transfer fee, typically between 3% and 5%. The compromise is a shorter introductory APR period for balance transfers.

A credit card with no balance transfer fees and 0% annual interest provides a way to pay off high-interest credit card debt without paying a penny in interest and fees, only if you can pay it off within one year. If you need more time, it may be best to consider a card with an interest-free balance transfer fee or a card with a lower prepaid APR period.

How do I decide if a credit card with no balance transfer fees is right for me?

The first step is to understand how much you can pay each month. Next, calculate how much interest and fees you will pay using two or three different balance transfer credit cards.

Generally speaking, if you can pay off your debt in about 12 to 15 months, it would be worth the 3% you save on your credit card with no balance transfer fees. If it takes 17 to 18 months or longer, a card like the US Bank Visa® Platinum Card can save you even more on interest payments, despite a 3% remittance fee (minimum $5). If you need more than two years to repay your balance, SunTrust Mastercard Prime Rewards may be your best bet. Don’t even discount personal loans. If you have a lot of debt and need several years to pay off your debt, you can get a personal loan at a lower interest rate than the introduction of SunTrust Mastercard Prime with a 3.25% annual interest rate on your balance. Before (the annual rate of change from 11.24% to 21.24% thereafter).

our methodology

CNET reviews credit cards against specific criteria developed for each major category, such as cashback, welcome rewards, travel rewards, and balance transfers. We take into account the general spending behavior of different consumer profiles and the specific features of the card, recognizing that everyone’s financial situation is different.

For cashback credit cards, for example, key factors include an annual “Welcome Bonus” fee and a cashback percentage (or percentage if different depending on your spending category). For Rewards and Miles cards, we calculate and evaluate the net cash value of each card benefit. With a balance transfer credit card, we analyze specifications such as an introductory 0% annual interest rate and a balance transfer fee, recognizing secondary factors such as standard annual interest rates and the length of time balance transfers must be made. Open your account.

More Credit Card Recommendations

*All information on the Wings Visa Platinum credit card, First Tech Platinum Mastercard and SunTrust Prime Rewards credit card has been independently collected by CNET and has not been reviewed by the issuer.

The editorial content on this page is based entirely on the objective and independent reviews of our authors and is not influenced by advertising or partnerships. It is not provided or approved by any third party. However, we may receive compensation if you click on links to products or services offered by our partners.

DevEnvExe.Com Tutorials, Tips and Tricks to design a Cross Mobile Development

DevEnvExe.Com Tutorials, Tips and Tricks to design a Cross Mobile Development